Lottery win? Big inheritance from a great aunt? Receiving a windfall is something we’ve all dreamed about at least once. Getting rich quickly gives us the freedom to leave our job and spend more time on other fulfilling activities. Retiring early doesn’t just mean giving up work (after all, we may find our jobs fulfilling). It means having 100% choice in how you spend your time. It means choosing whether to stay at your job or not.

Chances are you found this article after a bad day at work. Whilst disliking your work is not a prerequisite for early retirement it can often be the trigger to taking an alternative path to most working people. Fortunately, a windfall isn’t the only way to retire early.

There’s not a lot you need to know before you work towards early retirement (sometimes called FIRE or Financially Independent Retired Early) but you need to know some numbers and embrace the opportunity to optimize your lifestyle.

The Numbers

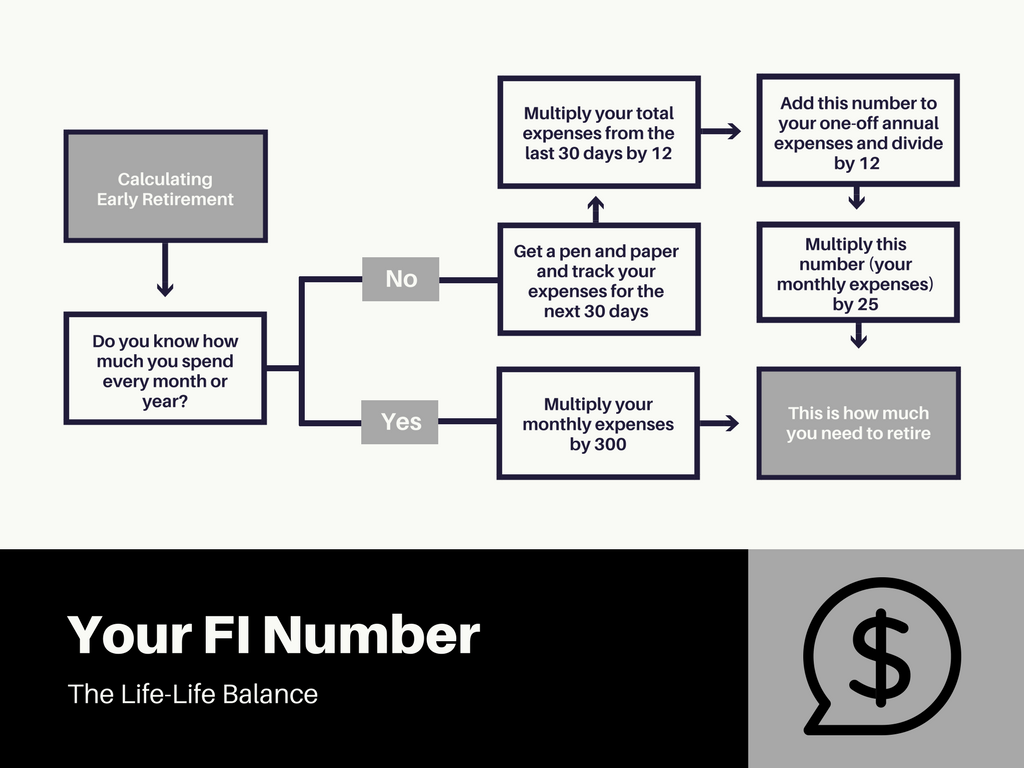

The first number you need to know is how much you spend on average in one month. If your monthly expenses vary, take the average by using a few months of expenses. Next, you can use this flowchart to show you what you need to retire.

Here’s an example:

If you spend $2500 a month, then once you have $1,000,000 invested you can retire early.

There are a few assumptions to be aware of:

-

As mentioned in the last point, your money has to be invested and the reason is that your money must be generating a return of 7% annually.

-

You will not withdraw any more than 4% annually from your early retirement pot.

-

Taxes. This varies by country, but here I’ve used the UK income tax rate of 20%. Since you’re still taxed in retirement above a threshold (currently you can earn around £11,500 a year before you get taxed) anything you earn above this amount is taxed at 20%. If you earn above the next threshold, you’ll start paying tax at 40%.

7% and 4% Explained

You might be asking where these numbers come from.

Over the longest study of its kind, it was concluded that 4% is the safest upper amount you can withdraw annually as income from your investments. This doesn’t mean that if you save money in a normal savings account that earns 5% annual, that withdrawing 4% is safe. This number assumes that your money is invested in the stock market or that it is generating a return of at least 7% annually. The idea is that you can withdraw this amount without the capital going down i.e. your pot stays at $1 million if that's the amount you retire with.

If you’re based in the UK, there are suggestions that your withdrawal rate is lower, but that’s only if you’re investing mostly in the UK stock market and less in the US market. As an investor based in the UK, I invest heavily in the US stock market (by buying an index fund which tracks the US S&P 500) so I will aim to use 3 - 4% as my safe withdrawal rate.

What about property?

If you own a property outright, you need to rent it out and earn $2,500 a month after all expenses and taxes to retire early. If you’re not already a landlord, you will need a lot of cash to purchase a property and rent it out. Most mortgages for rental properties require a bigger downpayment than your standard first-time purchase (10% vs. 40%).

Your Spending

There are two factors that affect your ability to retire: your spending and your savings.

What if I spend a lot?

If you spend a lot and wish to continue to spending at this rate when you’re retired, you’ll need to increase your income enough to cover your current spending and to cover your contributions to an early retirement fund. When you spend more you need to consider the tax implications. Each dollar you earn above a threshold could be taxed as much as 50%. It’s not my place to tell you how much to spend, but by having more expensive habits you will have to earn more and/or work for longer before you can retire.

What if I don’t spend much already?

Early retirement favors anyone who is already leading a frugal lifestyle. Since you don’t need to spend much on your lifestyle, you won’t need to have as much in your early retirement pot. Another bonus is that by needing less to live on, you’ll be liable for less tax. If you’re really frugal, you may not need to pay any taxes from your early retirement pot.

Your Savings Rate

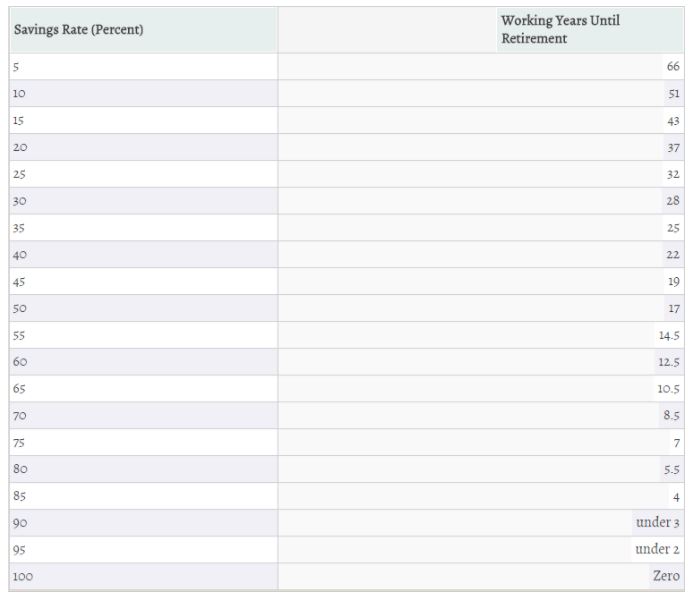

Now that you’ve calculated the figure you need to have invested in order to retire, you can use your savings rate to calculate how many years you have left until early retirement. There are a couple of great calculators online that can help you figure this out. My favorites are Networthify and Minafi. The first is great for simplicity and the second is great because it tells a story. Mr Money Mustache wrote an excellent article showing the simple math behind early retirement based on $0 in savings when you start:

As you can see from the table, the higher the percentage, the quicker you will retire. This is for two reasons. First, when your expenses drop your lifestyle is becomes more affordable. Second, when your savings increase you are adding more to the retirement pot and thus it grows even quicker with compound interest.

NB: You may want to spend more in early retirement and use some of the extra time to engage in activities like travel which you don’t do as often right now. I aim to spend nearly 100% more a month in early retirement so I can cover the costs of kids a mortgage and travel. I only have the latter cost to worry about for now. There's also the consideration of kids too. It's challenging for both parents to work fulltime when you have a baby, so it's likely you'll be on part-time salaries at some point in your adult lives.

The Bottom Line

The bigger the gap between your expenses and your income, the quicker you’ll reach early retirement. This can mean…

- increase your income

- reduce your expenses

- both of the above

You may get that windfall, but in case you don’t, it’s worth considering how you can work towards early retirement today.

Your Money, Your 20s is available for just $1 until 27 January 2018.