Update

The response to this post has been powerful, and we've had many requests for tools to help. I've created a free site which helps with calculating early retirement in a variety of different places around the world: [nomad saver](http://nomadsaver.com "target="_blank)

This is the final instalment in a three part series. Here are the sections, with links to navigate around:

[Part 1: Why](GHOST_URL/how-to-escape-the-rat-race-a-zero-bs-guide-part-1/ "target="_blank)

[Part 2: How](GHOST_URL/how-to-escape-the-rat-race-a-zero-bs-guide-part-2/ "target="_blank)

Part 3: What [This post]

Post are best read in order, but if you want the quick fix then this is the section for you. Part 2 is about why quick fixes don't work.

Part 3: Rat Race Escape Routes

I have been impressed with the urgency of doing. Knowing is not enough; we must apply. Being willing is not enough; we must do.

-Leonardo da Vinci

Here, we look at the ways to escape the rat race, and then more importantly, ingredients to improve their potency, and ways to chain these escape methods together so that you can manage your risk. If you are not sure why you would want to pursue this goal, be sure to check out [part 1.](GHOST_URL/p/0b0b89ef-8aed-4fe0-a9b5-7b9f471cf327/ "target="_blank)

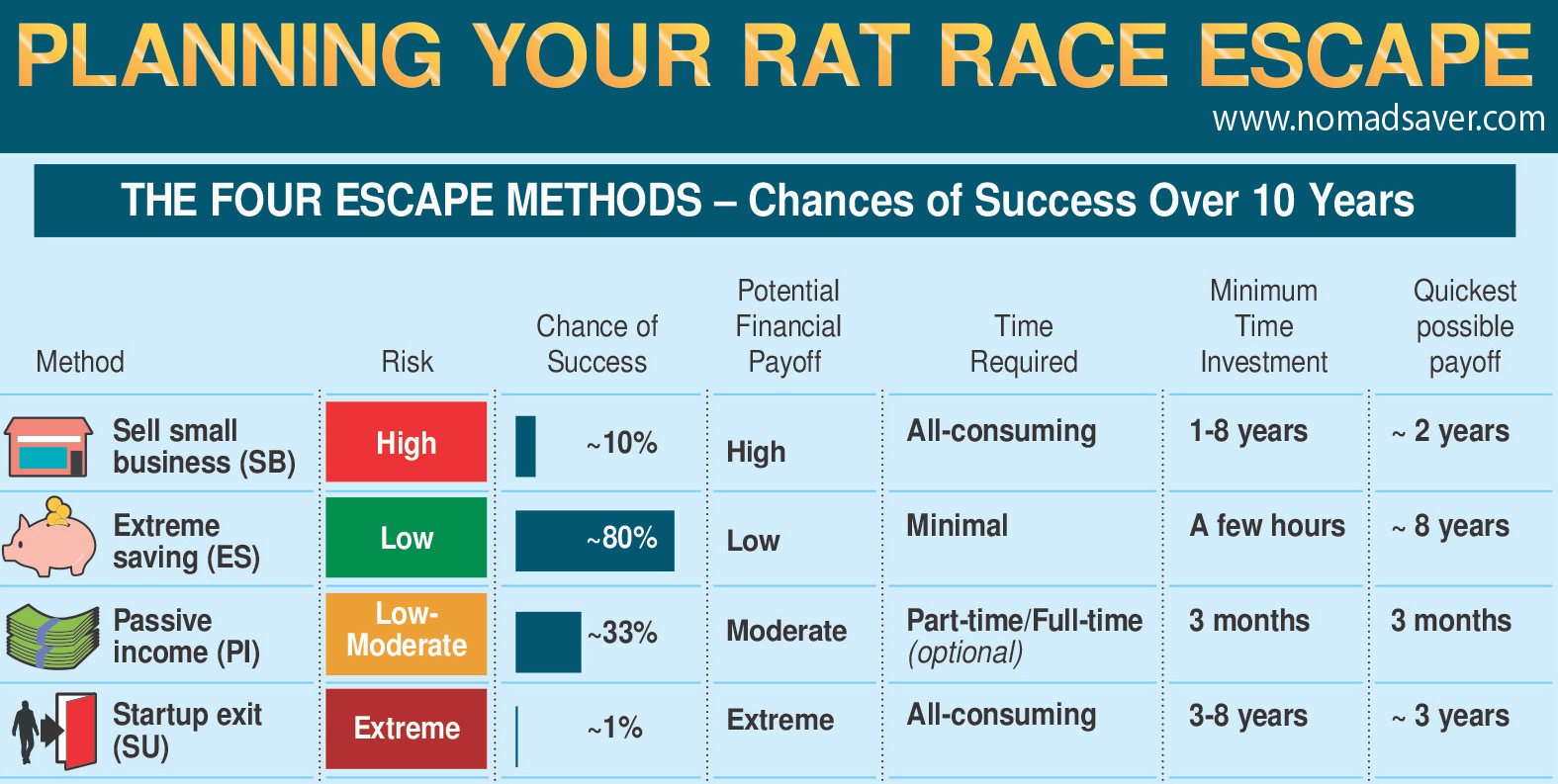

There are four main ways to escape the rat race permanently:

- Building and selling a small business

- Extreme saving - and acquiring income generating assets (cash, property, stock, bonds)

- A passive income product/business

- Founding and selling successful startup (or being a very early employee at one)

We ignore the gap year/sabbatical type of option, which, whilst often extremely valuable (particularly for planning a real escape), is only a temporary respite and ultimately an illusion of freedom.

1. Building and Selling a Small Business

I distinguish between "small business" and "startup" in the following way: we assume that a small business follows a clearly established and easily copied business model, doesn't require much financing, and is profitable relatively quickly. Furthermore, it does not grow beyond a certain size. In short, a less risky endeavour than a startup.

There are a lot of sub-types within the umbrella term "small business", let's consider the following:

A. Cannot operate without you (and hence cannot be sold)

e.g. One-person consultancy business, one-person dental practice, a restaurant where you are the star chef

B. Requires your input, but can be sold and/or handed over to a replacement after it grows to a certain attractiveness

e.g. A business with assets and intellectual property, a services business with processes in place and an existing customer base, a successful restaurant/fast food franchise, a large blog with multiple writers, a laundrette.

Option A doesn't get you out of the rat race anymore than being a regular employee, except it might be easier to work from home and/or work remotely. On the other hand, option B allows you to sell the business or hand over day-to-day management to someone else whilst continuing to receive a share of the profits. Option B is what you are looking for.

What this boils down to is not trading your time for money. Financial independence is about creating alternative income streams. There are many books written about how to start a business, so I won't try and cover that here. The main thing is that as you pick the type of business you intend to start, you consider whether it falls into category A or B above.

2. Extreme saving

This is the route whereby you work as a regular employee, but save a much higher percentage of your monthly paycheck than average (usually > 60%). You invest said saved money in income generating assets, typically index funds, bonds, buy-to-let property etc. Once your asset "stash" generates enough income to cover your cost of living, you are retired.

A favorite reference for this topic is the [Mr. Money Mustache article on the simple math behind early retirement](http://www.mrmoneymustache.com/2012/01/13/the-shockingly-simple-math-behind-early-retirement/ "target="_blank). Basically, it's the point at which passive income (typically the ~7% annual return you can get on investments) is enough to cover your living expenses. For instance, if you have $500,000 of investments, and you can cover your living expenses with $25,000 per year, then you are financially independent. It will be less than that if you relocate somewhere with a lower cost of living, where you can live well on $1k per month - [I've built a tool to allow you to play with the numbers in different places.](http://nomadsaver.com "target="_blank)

A big part of this method is identifying what you really value. If you examine the trappings of a consumer-driven lifestyle, you will discover a lot of waste. Adopting a more skeptical view of consumerism and embracing a DIY mentality has allowed "extreme savers" with regular jobs to retire in their early thirties.

3. Creating passive income products or businesses

This refers to businesses or products which require an upfront time investment to setup, but once complete run automatically, i.e. generating passive income. Examples include:

- Software as a service

- ebooks

- smartphone apps

- e-learning courses

In contrast to other options, this option is relatively easy to pursue part-time (see the section below on chaining methods for why this is important).

4. Building and Selling a Startup (or being a very early employee with significant stock options)

This doesn't necessarily mean Zuckerberg-level success, but we are talking about the sort of business that gets acquired for many millions of dollars.

This option is the classic "high risk, high reward" choice. Most startups fail. Those that succeed become can generate enormous profits. There are two types of end-games for this approach:

- Build something and sell it

- Build something that you love so much you don't want to do anything else (an amazing result)

How to start a startup is also a colossal topic. The best place to start for that is [Paul Graham's blog.](http://paulgraham.com "target="_blank)

Key Strategies/Ingredients for Reaching Rat Race Escape Velocity Younger

As discussed in [part 2](GHOST_URL/p/234f9dac-7a84-4139-b6c5-18955543ec0a/ "target="_blank), your mindset, understanding what success means for you, and your core habits are highly likely to determine your success. Those are your foundation.

Then there are the the blocks directly above them: Some are critical, others are simply beneficial. I'm going to label them "ingredients". To use the analogy of cooking, your foundation is like your stove or oven. If you don't have that, you basically can't cook. Then the more of the ingredients you have, the more likely your dish is to turn out well. Sometimes you can get away with skipping one or two, and sometimes having one crucial ingredient missing ruins the whole thing. In this analogy, the dish is your life and a ruined dish is you leaving the rat race at the legal retirement age.

Ingredients

Ingredient 1: You must be able to save a reasonable amount of money

There are two ways you can do this, which are mutually re-enforcing.

Spend less money

This is the area where people can see the biggest gains, rapidly. In the west, people do not save a lot of their paychecks. That is stupid for so many reasons. You should aim to save at least 20% of your paycheck, and ideally >50%. For many people, this requires a significant psychological shift. For a detailed breakdown of this, [I recommend the Mr. Money Mustache blog](http://www.mrmoneymustache.com/ "target="_blank). However, some key tactics to consider:

- [Track what you spend.](GHOST_URL/track-what-you-spend/ "target="_blank)

- [Stop worrying about "keeping up with the Jones's"](GHOST_URL/how-to-stop-keeping-up-with-the-joneses/ "target="_blank) the whole thing is a giant scam designed to keep you a slave.

- Crush lifestyle inflation. Carefully consider all major purchases.

- Certain types of jobs allow you to save a lot of money because they cover key living expenses such as housing and food: boarding school/international teachers, oil workers, diplomats, senior expats are examples

- Avoid debt (see ingredient 4)

- Try and live somewhere cheap. If you are a badass, try working remotely in Latin America/South East Asia (as many "digital nomads" do), whilst earning a western wage, you will progress much faster.

[Someone thoughtful made a tool to allow you to play with the numbers.](http://nomadsaver.com "target="_blank)

Earn more money

Some people get paid more than others. You want to be one of those people. Everybody knows this, but actually there is a huge amount of ignorance about where the money is. Here is a quick primer:

If you can work somewhere where you get a percentage of the proceeds, you are likely to be able to earn much more:

- Investment Banking (please stop sending me hate mail and [read part 1](GHOST_URL/p/0b0b89ef-8aed-4fe0-a9b5-7b9f471cf327/ "target="_blank) about why you are doing this)

- Serious tech startups/major tech companies (particularly in Silicon Valley)

- Sales (no, really)

In these industries/roles, it is common for people to earn more than $150,000 per year in entry-level positions. That is not an exaggeration. Bonuses, share options and sales commissions can end up worth millions.

Alternatively, if you can carve a specific niche where your skills are highly in demand, that may also be lucrative:

- Patent/Trademark/IP law (although generally I think that becoming a lawyer is a really tough, risky and expensive path right now)

- Certain types of surgery

- Certain types of real estate development

- SEO (if you are good)

- Extreme environment work (e.g. private security in war zones, maintenance on oil rigs).

If you can't get a job that pays well, then consider getting a second job. If you are young, this is particularly plausible, and a good way to broaden your skills.

There are many gotchas, and any given choice needs to be carefully considered against market and technological forces. For example, AI is getting really good at doing a radiographers job (in certain parts of the world, those guys earn a lot). Training as a radiographer now is probably a bad idea. In the UK, becoming a doctor is increasingly fraught with stress and extremely long hours. In the US, many professions (such as medicine and law) require vast university tuition expenses. Which leads us onto the next area to consider:

Ingredient 2: Marketable Skills

Acquiring marketable skills will help with all four escape strategies. It will allow extreme savers to earn more, passive income generators to build products with less assistance, and business/startup builders to do more themselves whilst being more critical of potential hires.

You can learn a lot on the Internet. [Scott H. Young did the MIT computer science degree in one year](https://www.scotthyoung.com/blog/myprojects/mit-challenge-2/ "target="_blank). I learned to iron from youtube videos...

The popular western myth that you should "follow your passion and you'll never have to work a day in your life/then the money will follow" is, by and large, a load of guff. This is for a number of reasons:

-

"Passion" is only really born of sweat. You first have to invest serious time into a subject or activity before you have true passion for it. Otherwise you are just passionate about the idea of something (see everyone who thinks they are passionate about writing but never writes). Unless you work on things you are not passionate about (yet), you will never develop true interests.

-

Ability and success makes you passionate. If you see something take off, your interest in it will grow. These things also take time.

-

"The money" goes where there is product-market fit, which is rarely where your passion lies.

This brings up the question of university: Is it useful? And what should you study?

If I could wind back the clock, I would just spend the time I spent doing a masters degree on launching my own products. Generally speaking, university is overrated. But it can be very useful for....

...Living in the right place (at first)

- If you are not from the USA, study in the USA (don't get into debt, chase after the many scholarships like a demon). It is the most lucrative place to be. This will make it much easier to...

...Surrounding yourself with the right people

- If you are interested in entrepreneurship, try and live close to startup hubs, places where people are making things happen. Paul Graham has [written at length about how important being in a startup hub is](http://www.paulgraham.com/startuphubs.html "target="_blank)

Making good friends - forming deep friendships becomes harder the older you get. University is a great place to form lasting friendships.

If you have an offer from a top university (Ivy League, Oxbridge), it may be worth the cost. However, it's definitely not worth getting into tens (or hundreds) of thousands of dollars of debt if it is not a top-tier school. Instead, you should seriously consider European Universities (e.g. Scandinavia, Holland, France, Germany), where tuition fees are so much lower, and courses are often taught in English (it goes without saying that you need to be fluent in English).

As for the subject, I would say pick what you are best at, but throughout your time at university you should be cultivating skills on the side and building a significant portfolio which demonstrates marketable skills, such as:

- Video Editing

- Software Engineering

- Elderly Care

- IT security

- Photography

- Data Science

- Graphic Design

- SEO

- Digital Marketing

- Content Writing

- Translation

- Taking a really good selfie

Most university courses are really not that hard. If you work on your degree 9-5 Monday to Friday, you've got all of Saturday and Sunday to build your portfolio and learn other useful skills, and you can still get wasted every weekday night.

"Marketable Skills" come and go with, well... market trends. So think strategically. For example, as noted in Average is Over

The growing importance of marketing integrates two seemingly unrelated features of the modern world: income inequality and increasing pressures on our attention. The more that earnings rise at the upper end of the distribution, the more competition there will be for the attention of the high earners and thus the greater the importance of marketing

Ingredient 3: A Partner Who Gets It

If you are in a serious relationship, your attempts to escape the rat race will be much smoother, and less fraught with stress and resistance, if your partner is on the same page as you. This means agreement about budgets, planning finances together, allowing each other time to work on side projects and to study. If you are starting a business, your partner needs to understand that they are not going to see you very much for at least three years.

It is also beneficial if they can agree on the following topics:

On Not Getting Married Young

Chiefly to avoid "not getting divorced" (see crucial ingredients 5). You may think that you've found the perfect partner but most people are pretty naive in their early twenties. Give things time, make sure you see the other person at their worst. Wait until you're over 30, unless you are really sure.

Also, don't have an expensive wedding. It's an absurd waste of money. [Here's our post on how to do it for less than $6000.](GHOST_URL/how-to-have-a-great-wedding-for-under-6000/ "target="_blank)

On Not Having Children Young

Raising a child costs a lot of money (though of course, the amount varies wildly depending on your lifestyle). In your twenties, you want to be taking risks (via the various escape route combinations we will discuss in the next section), absorbing as much knowledge as you can, and generally becoming a more powerful Pokemon. It is much harder to do this if you have got to take care of a child. To state the obvious: They are tiring. Raising children is something I really want to do, and which I think is a very worthwhile goal. But I want to be able to do it from a position of freedom, not raise them in little chunks of time that my employer allows me. As with getting married young, there is nothing wrong with having kids young, people have the right to live their lives. However, in the context of escaping the rat race, it is likely to make your challenge that much harder.

Real Talk Alert: If you are a man, it will make things easier if you end up having children with someone younger than you. This will give you more time to escape the rat race before your partner's "biological clock" starts putting additional pressure on you. Not a popular thing to opine, but true.

Real Talk Alert 2: If you date someone from another country, especially a country that is less developed, visa and mobility challenges are extremely real. Not saying don't do it, but make sure you go in with your eyes open.

Ingredient 4: Avoid Debt

Debt is the opposite of freedom. Think very carefully before making decisions which put you into debt. Even with the classic exception to this rule, property, make sure you are not over-reaching, and definitely never get a mortgage that will take longer than 15 years to pay back.

Ingredient 5 (The Magic Ingredient) Don't get divorced!

When you get divorced, your ex-other-half is likely to get a lot of your money. Maybe half. Do you enjoy playing games of Russian roulette where there are three bullets in the gun? 50% (or something like that) of marriages end in divorce. Are you really sure about this person? Like, really sure? 'Nuff said.

Effectively Combining Escape Routes

This is where the real gold in this whole post is located. There are smart ways to go about managing the risks inherent to the rat race escapes strategies, whilst balancing your quality of life.

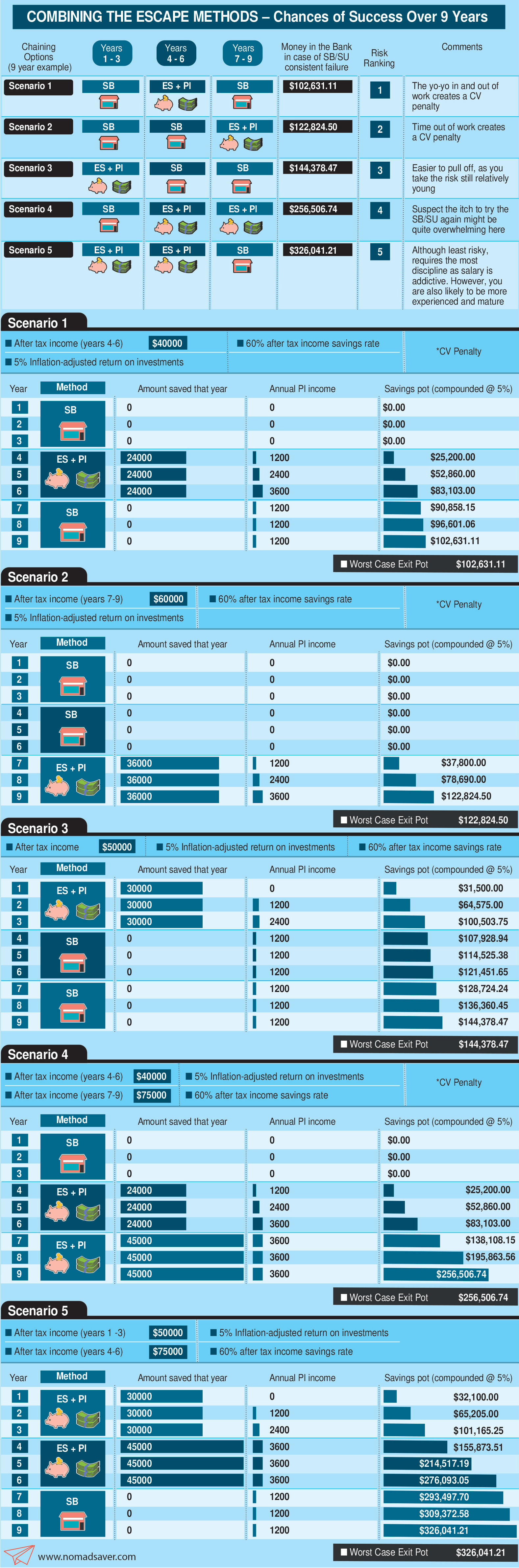

"Chaining" escape strategies, is combining them in different permutations. It is quite possible to spend years working on a business, then spend years pursuing extreme saving, then to join a startup. However, certain combinations perform better than others.

To begin, let's consider the best and worst case scenarios of the four escape strategies without any alternation - i.e. just sticking to one and never trying anything else over a ten year period:

| Method | Chances of Rat Race Escape | Reasonable Worst Case Scenario | Reasonable Best Case Scenario |

|---|---|---|---|

| Building and Selling a Small Business | Low-Moderate (<20%) | None of your businesses ever really made a lot of money, and you had to shut them down eventually. You have a lot of valuable skills. You have very limited savings | Your small business grew well and you sold it for just over a million dollars. After taxes and expenses, you've got enough money left to retire very comfortably. |

| Extreme Saving | High (>80%) | You are half way to financial independence, but the past 10 years you've lived much more modestly than your friends. You wonder if it was worth it. | You managed your income and costs intelligently from the age of 21, and are now financially independent |

Creating passive income |

Moderate (<33%) | None of your products ever made much money, but because you worked on them part-time you didn't lose much apart from your free-time, and you learned a lot of valuable skills. | After a lot of hardwork, you have multiple legitimate passive income streams and are now not just financially independent, but rich. |

| Building and selling a startup | Extremely Low (<1%) | Your poured 5 years into two different startups, they both failed. You are broke and burned out. | Your startup was IPO'd and you are completely loaded |

What can we note from the table above? Well, first of all only one option provides near-certainty of escape, and that is extreme saving. But this route is long, and if you are starting later in life, very long. On the other end of the spectrum, starting a startup is much riskier than most people usually acknowledge.

Now, what if we try combining different approaches? To illustrate this idea, I've created the infographic below. It shows 5 different sequences one could attempt over a nine year period, broken into three year chunks. In this example, we consider an imaginary person's choices from leaving college until the age of 31. These years make for a good case study because they are more likely to be able to take risk (fewer family commitments, good health) - but there is nothing to say that similar sequences could not apply to an older (or younger) person.

Assumptions:

- I have deliberately assumed more average US household income (starting at $40k), meaning that for those with more of the ingredients discussed earlier these projections are very conservative indeed.

- During Small Business/Startup phases you are unable to save, however you do not draw down from your existing savings

- Profits from passive income are relatively low, they could be much higher

- For those routes that involve not going to work at a company with a reputation, I've added a CV penalty - this isn't always the case, but it's a risk to consider.

Thinking through these scenarios shows that you that certain sequences have far more favorable outcomes. You can mitigate the risks of starting a business (or a startup) by engaging in extreme saving before making the leap. Alternatively, if you do want to start a business early, cutting your losses fast if it is not working leads to a better outcome (if the business would go on to fail, which of course you would never know). These are obviously huge simplifications and generalizations - the point is to stimulate thought about how you time your escape strategies. In reality it is incredibly hard to know when to shutdown a business, and people toil away for years on projects that appear promising but ultimately do not bear fruit. Also, opportunities do not come at the most convenient times. The point is to at least have the broader picture in mind, to understand the game as you think about how best to play the cards you have been dealt.

7. On meaning and value

I am not saying that everyone should become an investment banker, shun serious relationships and chase money like an incensed Gordon Gecko.

What I am saying is that money is a tool which can unlock freedom and the potential for a more fulfilled life. If you feel empowered and passionate about how you spend your time, and it doesn't pay well, then carry on. But, if you feel the pain of the rat race and find yourself wishing for a different day, then take control of your life by thinking carefully about the advice in this post.

As you journey, enjoy the moments. If you are pursuing extreme saving, live your life like you're financially independent but just in smaller ways (weekends, holidays, after work) and see what parts you enjoy and what you can live without. If you are building a business or a product, savour the ride, and marvel at all the things you learn.

And through it all, be grateful. The sad truth is that there are millions of people who would love to be in the rat race, but were born in the wrong place, family or circumstances to have the opportunity.