In 2016, UK house prices are now nine times average incomes. Since the 1990’s, property has become a mainstream investment. The 1990’s property crash provided a great opportunity for any potential property investors, not just because of the low cost of housing, but because mortgages were more accessible with more than one mortgage provider offering 100% loan-to-value mortgages (the first buy-to-let mortgages became available in 1996). The Telegraph reported in 2014 that private landlords own almost one out of five homes in Britain. The popular personal finance book, Rich Dad, Poor Dad, argues that investing in real estate/property is a sure way to build wealth, but is it really as easy as it sounds?

A simple investment

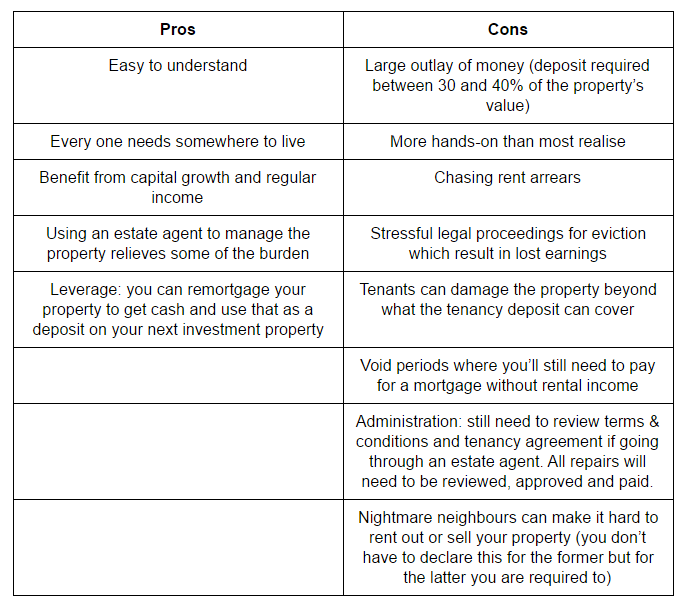

Property is one of the easiest investments to understand. You purchase a flat or house (with or without a buy-to-let mortgage), you buy some furniture and you let the property out (with or without an estate agent). Many people I’ve spoken to feel comfortable with investing in property because they feel it’s safer to have money in bricks and mortar than any other investment. Everyone needs somewhere to live. Property is simple to understand, but some people have been caught out by the perceived simplicity of property.

People: An unpredictable investment

Buy-to-let investments involve a lot of people. To buy your investment property, you deal with estate agents, current owners, surveyors and conveyancers. Once you own the property, you deal with estate agents, cleaners and prospective tenants (even if it’s managed by the estate agent, you’ll still have to keep up to date with the type of tenants that you’ll have in your property). Once you have let out the property, you’ll either deal with the tenants or the estate agents and sometimes both. You also need to declare your earnings to the taxman (HMRC in the UK) via a self-assessment tax form. Up until now, you could declare your income after taking into account any expenses you incur from owning the property including:

- letting agents’ fees

- legal fees for lets of a year or less, or for renewing a lease for less than 50 years

- accountants’ fees

- buildings and contents insurance

- interest on property loans

- maintenance and repairs to the property (but not improvements)

- utility bills, like gas, water and electricity

rent, ground rent, service charges - council tax

- services you pay for, like cleaning or gardening

other direct costs of letting the property, like phone calls, stationery and advertising

From April 2017, the changes to tax legislation mean that mortgage interest payments will no longer count as deductible expenses, increasing many landlords’ tax burdens.

The darkside of being a landlord

If you could buy a property and rent it out to ideal tenants who pay the rent on time, then you only need to be involved to carry out maintenance. If you have what seem to be ideal tenants on paper who do not pay their rent, then you quickly become familiar with the dark side of being a landlord: you may need to seriously consider evicting tenants. When you rent out a property to more than one tenant, using a joint tenancy agreement, if one tenant needs to leave due to extenuating circumstances, they and the rest of the tenants on the joint agreement are legally obliged to find a suitable replacement that can pay their share of the rent. There’s no telling whether that person will find a suitable replacement before they leave. If, in the case of working professionals, the tenant has not provided a guarantor, the landlord will need to chase the other tenants for the entire rent not just their individual shares which is when the uncomfortable situation unfolds… Evicting tenants is costly: Shelter estimates that the typical cost of evicting a tenant for rent arrears totals £1,900-£3,200. That doesn’t account for the emotional distress and sleepless nights. You’re also not guaranteed to recover rent arrears if using the accelerated possession procedure which is one of the fastest ways to get tenants out.

Shelter estimates that the typical cost of evicting a tenant for rent arrears totals £1,900-£3,200.

A friend of mine has told me other horror stories of what it’s really like to be a landlord. One group of tenants left a property in need of thousands of pounds in repair costs. The landlord used the whole deposit to cover the repair costs but the damage cost 3x more than the deposit meaning the landlord could either cut his losses and pay, or explore options to sell the property. Another landlord arrived at their property to find that all of the furniture had been taken by their tenants whose email address and telephone number mysteriously stoppped working. He could recover some costs from the deposit but the furniture cost more than what was held as a deposit.

What are the returns on a property investment?

The rental yield that you get on your property depends on how many bedrooms the property has and where it is located. According to London Property Watch, rental yields in London are between 2.2% and 5.7%. Although demand in London is high, the rental yields achieved on property are not as great as other places in the world such as Florida and NYC. The added bonus of owning a property is not just the rental yield, but the potential for capital growth: your property may increase in value while you are drawing passive income from it. If your property grows in value, you can either sell and reap the profits or, you can remortgage the property, and use the money you’ve earned through capital growth to purchase another investment.

An unpredictable government

In the recent UK budget, George Osborne introduced three tax policies which will affect all current and future landlords:

- Landlords are excluded from a drop in capital gains tax

- Landlords will pay a 3 percent surcharge in stamp duty (while scrapping a planned stamp duty exemption for larger landlords, meaning those who already own 15 properties already will also have to pay the extra tax)

- From April 2017, landlords will not be able to deduct their mortgage interest payments from their rental income before calculating their tax bill

Changes to tax policies don’t end here. There’s no easy way to predict if future tax policies will penalise landlords even more. The government are introducing these policies trying to tackle the growing demand and short supply of suitable housing. By increasing the tax burden on landlords, many landlords will need to consider selling properties in their portfolio that no longer break even. The government hopes that this will increase the number of properties available to purchase for first-time buyers.

There’s no easy way to predict if future tax policies will penalise landlords even more.

How easy is it to invest in property?

Buy-to-let mortgages are mostly available when you already have a mortgage on the property you live in. When I was looking to invest in a property to rent out, I was still renting and realised that I wouldn’t be able to get a buy-to-let mortgage. I had the right amount of deposit to get a 65% loan-to-value mortgage, but because I had no history of a mortgage, the mortgage providers gave me a resounding, “No!”

If you already own a property, you’re more likely to be accepted for a buy-to-let mortgage. Buy-to-let mortgages are currently available at 60 - 70% loan-to-value i.e. you’ll need to come up with 30 - 40% of the price of the house as a downpayment once your mortgage has been approved. The plus side is that you’ll owe less to the bank than you might for a standard 90% loan-to-value mortgage and the credit check is less intense than buying a home to live in because mortgage providers focus on the rent you expect to receive on the property. Putting up a substantial amount of money means your monthly payments will not be as high and you can set the rent at a reasonable rate.

Property vs. Other investments

When I look at investments, I’m not just analysing the potential returns. I also focus on how much work and management is involved. I’m a DIY-investor working part-time and trying to freelance, so simplicity in my portfolio is key. I don’t want to deal with many people when I invest and I prefer to do 100% of my portfolio management online from anywhere in the world.

Property is also risky in the short-term from a liquidation perspective

Knowing what you’re investing in is sound advice for any investor. Anyone can understand investing using a buy-to-let property, but the problem is that many of us have tunnel vision when it comes to investing. I still hear people around me talk about stocks and shares being too ‘risky’. When I ask further questions, it quickly becomes clear that people think that stocks are risky because they’re only taking into account the 2008 credit crisis when the FTSE 100 index dropped by 391 points (or lost 8% of its value), or they think of headlines where individuals have lost all their money because they purchased lots of stocks for one or two companies. This view only considers the short-term returns. Like stocks, property is not a short-term investment which many investors accept, but many can forget that property is not very liquid (you can’t access your money quickly), whereas liquidating stocks and shares can sometimes be done overnight. It’s important to remember that stocks and shares are risky in the short-term because of short-term volatility in the market, but property is also risky in the short-term from a liquidation perspective.

As with any investment, knowing your facts and doing your research is key. One the biggest barriers to entry for property is the huge deposit that you need to put down either to purchase your first home or to purchase your first buy-to-let property. Since many of us 20-somethings don’t have tens of thousands of pounds sitting in a bank account, it’s unlikely that property is an accessible investment.

Is the answer to quietly save up for a deposit and only wait to invest when we have enough for a property? No. We need to explore the alternatives to grow our money now.

Conclusion

If you inherit a property or a lump sum that gives you the ability to invest in buy-to-let, it makes sense to invest in something you are comfortable with and that you understand. However, if you’re the type of person who doesn’t enjoy beings hands on with their investment, you may want to think twice about property. I’ve spoken to several landlords who say, “It’s never as simple as finding good tenants and watching the money flow in. You have to be actively involved when their are maintenance issues or rent arrears, even when you hire an estate agent to manage the property. Nearly every repair has to be approved by the landlord.”

There are plenty of other ways to grow your money without a buy-to-let property

Alternative property investments

If you’re still interested in becoming a property investor, you can gain from the property market without purchasing a buy-to-let investment, by investing in a real estate investment trust or property fund.

Or, if you’re like me and thousands of other 20- or 30-somethings who’ve been patiently building a deposit only to find each attempt at getting on the property ladder thwarted, then there are plenty of other ways to grow your money without a buy-to-let property. There are several investment vehicles which are more accessible i.e. you don’t need a lot of money to get started.

Other ways to invest your money:

Peer-to-peer lending

Taking the banks out of the equation means that you can lend money directly to individuals or businesses using crowd-lending platforms - you lend £10 or £20 along with hundreds of other investors. You spread your risk and you can gain between 5 and 8% per year on your investment. You can invest in peer-to-peer lending with as little as £100 for Zopa, Funding Circle and Lendinvest, and you can set your own rate of return by increasing or decreasing your level of risk.

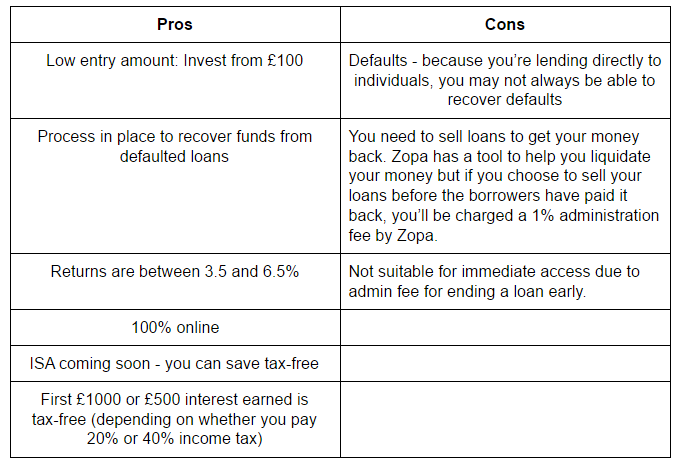

Zopa

Over 10 years old, Zopa is one of the oldest peer-to-peer lending platforms. You can lend money to individuals who are borrowing the money at a better rate than if they were to take out a loan at the bank. I’ve been investing with Zopa since 2011 and have achieved returns that beat all of the most competitive savings accounts.

Read more: Zopa

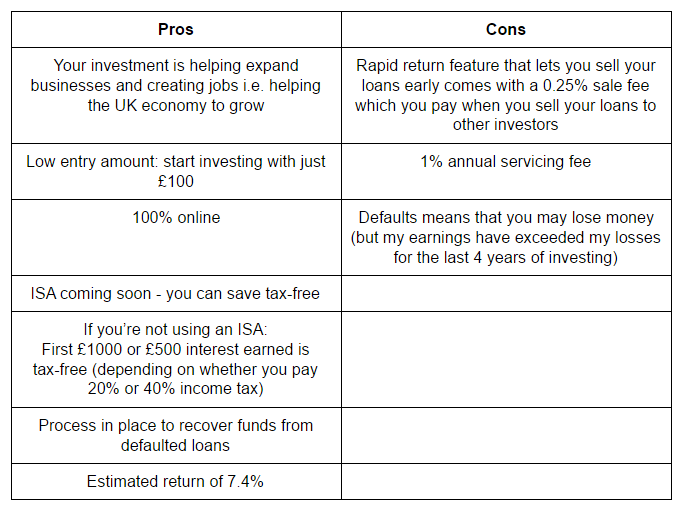

Funding Circle

The next well-known peer-to-peer lending platform, Funding Circle, uses the same principles as Zopa but instead of lending to individuals you’re lending to small- and medium-sized businesses in the UK. Investing with Funding Circle for the last four years has been the most lucrative part of my entire investment portfolio. I achieved around 8% until recently and now I earn around 6%. I’ve experienced more defaults with Funding Circle than Zopa, but overall I have made more money with Funding Circle.

Read more: Funding Circle

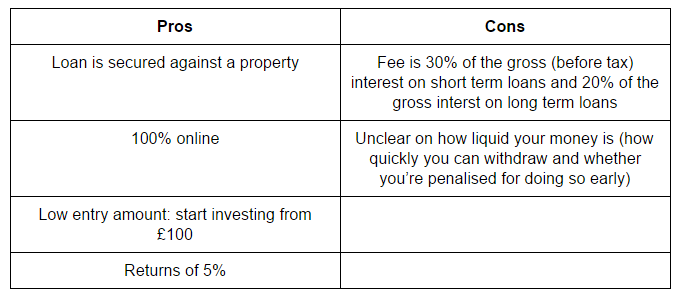

LendInvest

LendInvest is a crowdlending platform for property. The money that you invest is put towards loans for residential and commercial mortgages.

Read more: LendInvest

Stocks & Shares

I only invest in stock index funds and I keep all my funds in a stocks and shares ISA. I’d highly recommend reading our summary of The Boglehead’s Guide to Investing and our ebook, The Top 10 Personal Finance Books of All Time, to help you understand stocks and shares and investing in just a couple of hours. Learn more about our ebook.

Read more: How to set up a stocks and shares ISA

Traditional bank accounts

I regularly look for new savings accounts. Since personal finance is one of my hobbies, I don’t mind spending time to find a better deal on my savings. Some will argue that I could spend my time building my income, which is true, however, I find it quite therapeutic using downtime in the evening, when I can’t focus on much, to look for a new savings account.

Regular savings accounts

You can put between £50 and £250 into a regular savings account which usually offers a more competitive return than easy-access savings accounts. You cannot save a lumpsum, you will be penalised with a lower interest rate if you don’t pay in every month and you cannot access the money until the regular saver has matured (usually after 12 months). My latest one with First Direct offers a 6% interest rate but it is only available to First Direct current account holders.

Want to build the savings habit?

Read these articles:

- Find your why: why you should save money

- Why you won’t regret cutting back on your spending

- Why did I buy that?

Images courtesy of jennythip, digitalart and Stuart Miles at FreeDigitalPhotos.net