Waking up early, finishing late, deciding what to eat for lunch, learning the ropes of your role and a paycheck. When you start your first full-time, permanent job you’ll experience all of these. But, there’s one experience that 20-somethings should be most excited about: earning compound interest.

Compound interest occurs when, first, you earn interest on your savings and then earn interest on the interest you just earned. Similarly, when you take out a credit card, and you don’t pay it off in full, you are charged interest. If you then don’t pay off in full and you don’t pay the interest you’ve been charged, you are then charged interest on the interest you were charged to begin with on top of repaying the lump sum that you borrowed.

Put simply: When you borrow money, you pay interest. When you save money, you earn interest.

Why Einstein Called Compound Interest the Eighth Wonder of the World

Einstein also said, “He who understands compound interest, earns it...he who doesn’t...pays it.” To demonstrate the power of compounding, I have shared three scenarios.

Basic Saving. You pay into a basic savings account for 5 years earning interest at 1%.

Basic Investing. You invest in the stock market for a minimum of 10 years (this is not an easy-access account if you want to let compound interest work) earning 6%.

Investing for Retirement. You contribute to your retirement savings (and thus investing in the stock market with a return of about 8%) but there’s a catch: I also demonstrate the impact of putting off contributions.

Scenario #1 - Basic Saving

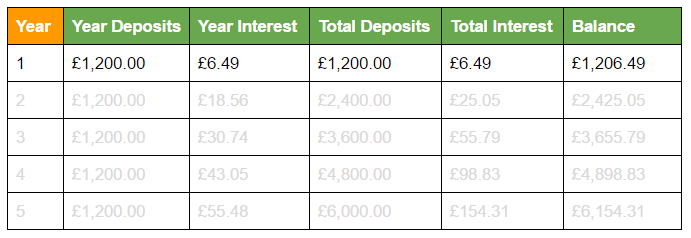

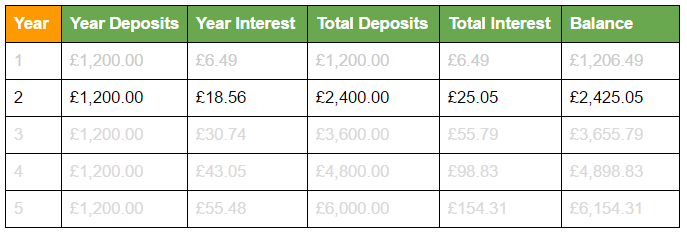

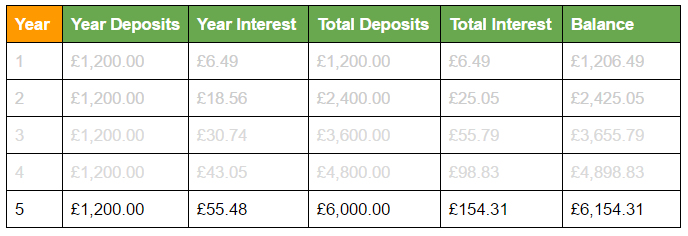

Let’s assume that you have no savings and you decide that from your next paycheck, you’ll start contributing £100 to an account which earns interest annually at 1%.* You’ll contribute this amount every month for the next five years.

After 1 year, you’ll have made £6.49 in interest which brings your year-end balance to £1,206.49.

After 2 years, you’ll have made £18.56 in interest which brings your year-end balance to £2,425.05. At this point, you have put away a total of £2,400 and you’ve earned £25.05 in interest.

After 5 years, you’ll have made £55.48 in interest at the end of the year which brings your year-end balance to £6,154.31. Given you’ve contributed a total of £6,000 over five years, the total interest earned is £154.31.

Scenario #2 - Basic Investing

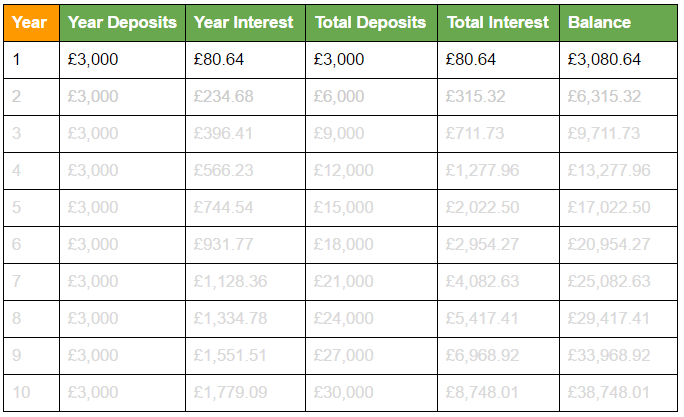

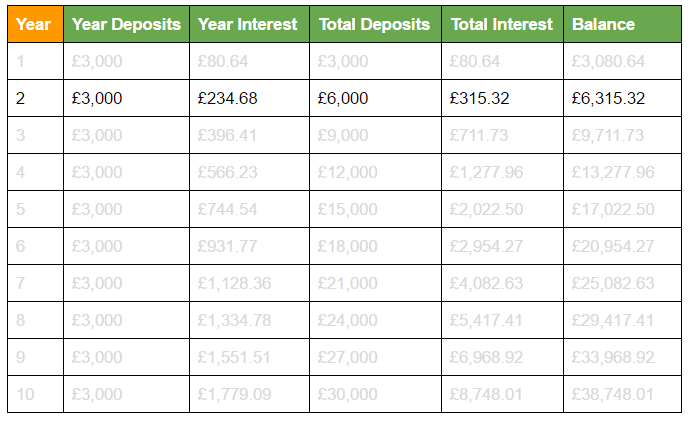

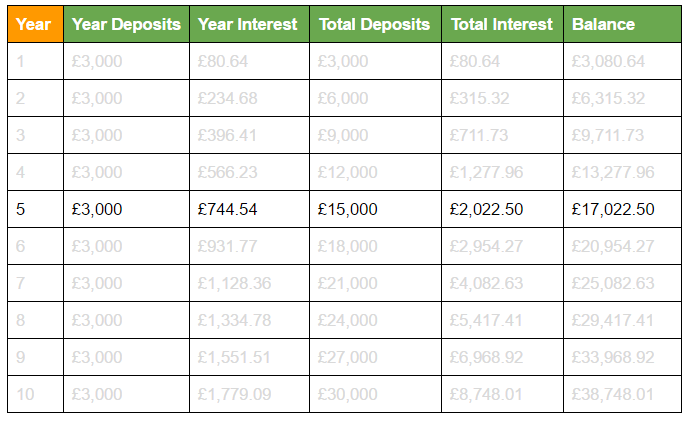

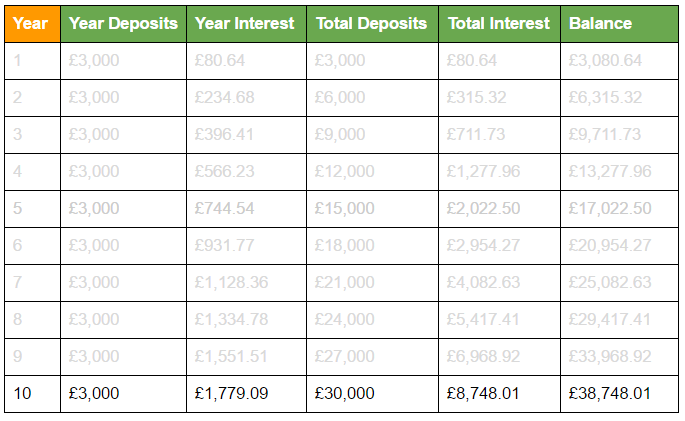

Let’s assume that you have no savings and you decide that from your next paycheck, you’ll start contributing £250 to a Stocks and Shares ISA investing in index funds which earns interest annually at 5%.

After 1 year, you’ll have made £80.64 in interest which brings your year-end balance to £3,080.64.

After 2 years, you’ll have made £234.68 in interest which brings your year-end balance to £6,315.32. At this point, you have put away a total of £6,000 and you’ve earned £315.32 in interest.

After 5 years, you’ll have made £744.54 in interest at the end of the year which brings your year-end balance to £17,022.50. Given you’ve contributed a total of £15,000 over five years, the total interest earned is £2,022.50.

Jump to 10 years and from £30,000 worth of contributions, your total balance is £38,748.01. Interest earned over this period? £8,748.01.

Scenario #3 - Investing for Retirement

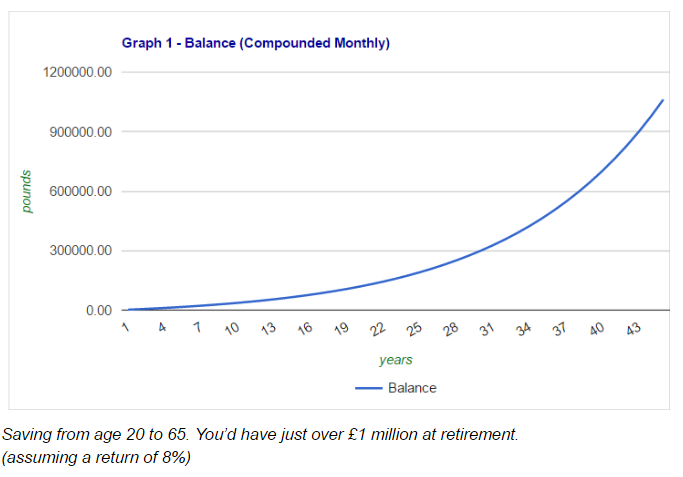

For compound interest to work in your favor, you need two things: regular contributions and time. Here’s how:

Retirement: Contributions from age 20 vs. contributions from age 30

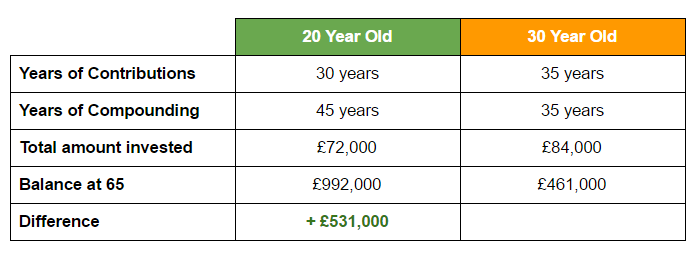

Imagine you contribute £200 a month into a retirement account from the age of 20 until you turn 65 when you start drawing money from your account. You earn around 8% interest and your interest compounds over 45 years. When you reach 65, you have just over £1,060,000.

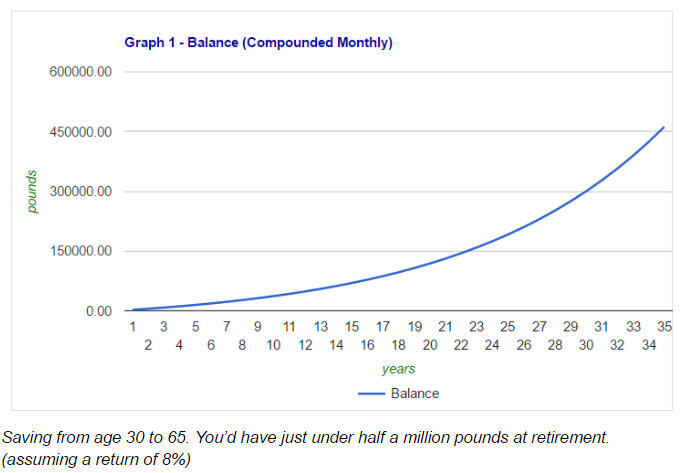

Now imagine that instead of starting to contribute £200 a month from the age of 20, you wait until you’re 30. You earn around 8% interest but your interest only compounds for 35 years.

How much would you have when you reach 65?

Around £461,800.

By waiting 10 years to start contributing, you’ll have less than half a million in savings.

Start early, Stop early

What if you started contributing at age 20 but you stopped your contributions between the age of 50 and retirement age (65)? Compound interest would still work in your favour.

If you contributed for 30 years and then stopped contributing from the age of 50 (15 years less), you would have contributed a total of...

£72,000

With compound interest, at the age of 65, the £72k would become...

£992,000

That's still £530,000 more at retirement than a 30-year-old who contributes for 5 years longer than the 20-year-old.

By delaying contributions to retirement, you...

- will have to make larger or more contributions

- may have to retire later

- may have to retire on less money

** I used The Calculator Site and one assumption is that you won’t get taxed on this amount as per UK tax rules that allow savers to earn £1000 worth of interest every year before being taxed. At the time of writing, an account offering 1.05% on savings was available.*

Why Many of Us Fail to Earn Compound Interest

Compounding is taught on school curriculums and yet many of us don’t earn compound interest as adults. The main reasons include:

- Putting off any kind of savings

- Getting into debt putting you on the wrong side of compound interest

- Putting off saving for retirement

- Thinking there’s no point saving a small amount every month

What If You Don’t Earn Enough?

I often hear from people who really want to start saving money that they don’t earn enough. If you don’t earn enough, you can either: earn more or spend less. Ideally, you do both.

Earn more

- Do overtime if it’s available

- Negotiate a better salary. I’m not an expert on negotiation, but that doesn’t mean I don’t negotiate. I just learn from better negotiators on the internet. Check out Ramit Sethi, author of I Will Teach You To Be Rich: No guilt, no excuses - just a 6-week programme that works

, for his Negotiation 101.

- Take on a part-time job

- Become a freelancer on Upwork

- Sell items around the home that you no longer get value from

Spend less

- Track your spending to find out whether you spend what you earn

- If you find you spend less than you earn, open a savings account and put the difference into the account. You can also see if your current or checking account offers a ‘sweep’ function which lets you sweep anything remaining in your current account after bills are taken into a savings account

- Use an online comparison tool to find out if you can pay less for your utilities

- Cook more vegetarian meals to save on the cost of meat or find more plant-based protein recipes

- Try the ‘basics’ range when shopping for groceries instead of picking brands. You may find you’ll need to stretch and bend down to reach this produce. Premium (over-priced brands) are usually at eye level or just below so that you can exert the least amount of effort to grab it.

How to Start Earning Compound Interest

If you’re already spending less than you earn, then you can earn compound interest in just three steps.

Start as early as possible. Start saving something as soon as you start receiving any money (be it from parents or a job). This is essential for your retirement savings.

Save regularly. No matter how small the amount, you can build savings with regular contributions.

Reinvest the interest. The interest you earn from savings compounds when you leave it in the account. Reinvest the dividends from investments (if you have investments).

If you want to discover more about how to build wealth in your 20s, check out Maureen's latest book: Your Money, Your 20s.

In this eBook you'll discover:

- Why your 20s are significant

- The importance of habit formation

- Key habits to form in your 20s